-

© Camer.be : Franck BAFELI with Youssouf Kone

- 17 Dec 2024 08:02:59

- |

- 3558

- |

AFRIQUE :: Dr Achille EKEU: ECO Currency Project and how it differs from the CFA franc :: AFRICA

In recent years, the issue of monetary integration in West Africa has become particularly relevant, especially with the emergence of a new project, the ECO single currency. Dr Achille EKEU Banker and Expert in High Finance, CEO of the investment bank «The Washington Valuation Group» based in Washington, USA, shares his views on the prospects for the implementation of the ECO and how the currency should differ from the CFA franc. According to Dr EKEU's insights, the creation of a single currency could be an important step towards economic integration of the region, but it also requires taking into account many factors, including the stability of the financial systems of the participating countries. In this context, he answers questions about the potential risks and benefits of moving to a new currency.

In the opinion of Dr Achille EKEU, « The main difference between the new ECO currency and the existing CFA franc is the issue of monetary sovereignty. The CFA franc, being a currency managed by France through the «Banque de France», has a fixed parity with the euro (1 euro = 655.96 CFA francs) ». This means that countries using the CFA franc are limited in their ability to manage the money supply and exchange rate, which in turn affects their economic independence.

The expert believes that theoretically, with the introduction of the ECO, it is expected that WAEMU (West African Economic and Monetary Union) countries will be able to regain some currency autonomy by abandoning fixed parity with the euro. He notes that this should allow African states to manage their currencies more effectively, which could favour economic development and reduce dependence on external factors. However, he also emphasises that France officially remains the guarantor of the ECO through the parity system with the euro. Thus, in his view, the region will remain dependent on the euro, which will not fundamentally change the position of the CFA zone vis-à-vis France.

Answering the question about where the ECO will be printed, the expert states: «As far as the printing of the currency is concerned, although the ECO project is supposed to introduce a symbolic and governance change, the ECO could still be printed in France. Indeed, the issue of printing the currency is crucial and remains unclear, although some experts believe that the printing process could remain under French control, as with the CFA franc. Full autonomy for African countries in the management of their currency is therefore not guaranteed».

It was previously reported that the Central Bank of West African States (BCEAO) was required to deposit half of its foreign exchange reserves with the «Banque de France». If the ECO project is approved, this practice could change. With the introduction of the ECO, the CFA zone could be freed from the historical obligation to deposit 50 % of its foreign exchange reserves with the «Banque de France», according to the expert. Until 2020, WAEMU was required to deposit a significant portion of its reserves (up to half) in this bank, a practice often denounced as a form of economic neo-colonialism. These reserves were used to ensure the stability of the CFA franc, but this limited investment in the region as the funds were locked outside Africa.

The ECO project reportedly plans to end this restriction, enabling African countries that are members of WAEMU to theoretically manage their foreign exchange reserves directly and use them to finance local development projects. However, it is emphasised that this development is not guaranteed. If France remains the ECO guarantor, there is a risk that it will continue to play an indirect role in managing reserves and currency stability, for example by remaining an intermediary between Africa and the eurozone.

Paris continues to be the official guarantor of the ECO, which, like the CFA franc, maintains a fixed parity with the euro. This provision has a number of negative implications for the West African region, especially in the context of monetary sovereignty and economic flexibility. Maintaining a fixed parity with the euro limits the ability of countries in the zone to adjust their monetary policies to local economic conditions.

«In figures, between 2008 and 2012, the CFA zone experienced a relative weakening of its exports in the face of international competition, in particular due to the appreciation of the euro. At the same time, France, as the region's main trading partner, continued to benefit from the stability of the fixed parity, strengthening its influence over African economies. This is a good illustration of how the monetary policy set in Paris can hamper local economic development», - noted Dr Achille EKEU.

The introduction of the new ECO currency represents an important step in the economic integration of West African countries. However, as the experience of the CFA franc shows, important aspects such as monetary sovereignty, guarantees and the printing process remain in question. Despite promises of greater autonomy, the reality may prove more complex. To reap the benefits of the new currency, the region's countries need to carefully consider all aspects and possible risks associated with the transition to the ECO. Otherwise, the new financial instrument may not be as groundbreaking as expected.

Pour plus d'informations sur l'actualité, abonnez vous sur : notre chaîne WhatsApp

Lire aussi dans la rubrique ECONOMIE

Les + récents

CAN 2025 : Etta Eyong offre au Cameroun une entrée victorieuse à Agadir face au Gabon

Message du président élu et légitime ISSA TCHIROMA au peuple Camerounais

Buea : La révolte de l'obscurité force ENEO à rétablir l'électricité

Le veto d'Etoudi sauve Alice Nkom d'une interpellation par Atanga Nji

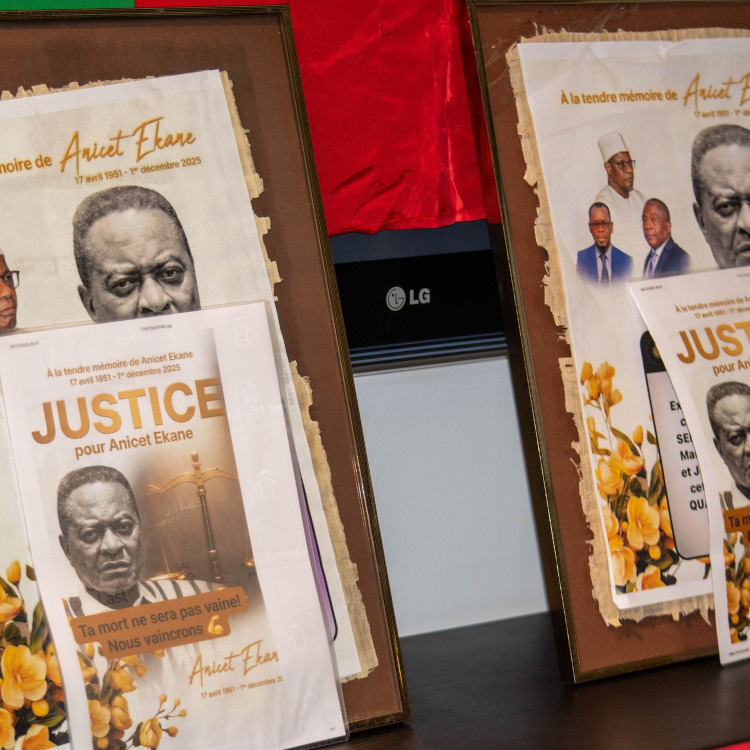

Affaire Anicet Ekane : La famille refuse la gendarmerie et exige une enquête indépendante

LE DéBAT

Afrique : Quel droit à l'image pour les défunts au Cameroun ?

- 17 December 2017

- /

- 219660

Vidéo de la semaine

évènement