-

© Camer.be : Franck BAFELI

- 25 May 2020 11:34:00

- |

- 1046

- |

CAMEROUN :: Amid crisis, Sahara delivers oil products at pre-Covid-19 prices :: CAMEROON

The rates Nigerian trading house Sahara has applied since late February are likely to cost the Cameroonian state tens of millions of dollars in subsidies.

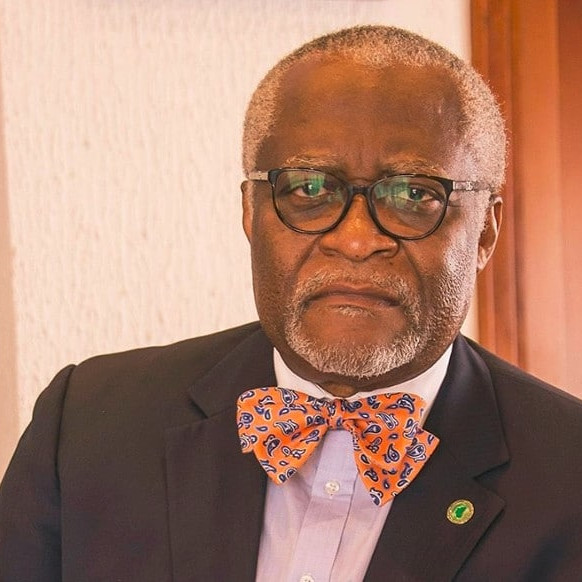

As we understand, Cameroon's minister of energy Gaston Eloundou Essomba decided to renew an oil supply deal with Sahara Energy in an over-the-counter arrangement in early April. Essomba asked the trader to provide the countries' distributors with 180,000 tonnes of hydrocarbons (225,000 cubic meters), the equivalent of 45 days of consumption, at March prices (see document).

As a result, oil distributors in Cameroon will pay considerably higher prices for their supplies in May and June than those practised on international. In his letter to Sahara, the minister justifies his decision by the need to build a safety stock in order to avoid supply shortages that could be caused by the Covid-19 crisis.

When contacted by Africa Intelligence, Sahara made it clear that they did not wish to comment and sent the ball back in the ministry's camp. Neither the prime minister Joseph Dion Ngute nor finance minister Louis-Paul Motaze were consulted over the decision to extend Sahara's contract.

A revival of the January bidding round

The minister's decision expressed in the letter is itself a prolongation of a previous deal made with Sahara after having won a bid round (Africa Intelligence, 08/05/20) that allowed the Nigerian trader to sell petroleum products through March and April at February prices. This covered cargos of a total 240,000 cubic meters (see document) that arrived from late February onwards.

Sahara is basing its position on the bidding round won in late January but that was before oil prices collapsed as a result of the global pandemic. The firm, which enjoys a sympathetic ear within the presidential family, did not adjust its rate accordingly. It is understood there will be an average $350/t difference between Sahara's prices for the period between March to June compared to market rates. The price tag for the excess could cost the Cameroonian state tens of millions of dollars by the end of June.

Wiping out the competition

Other than the issue of price, part of the cost of which Yaoundé will end up bearing because of the massive fuel subsidies practised in Cameroon, it is the resulting quasi-monopolistic situation that other traders used to working in the country - Mocoh, Total and

Vitol have been lambasting in private. Just one 10,000-tonne cargo from Mocoh has been able to unload in the port of Limbé since the end of February. And this cargo was ordered in January, before Sahara's deal with Yaoundé, and had been forced to wait 45 days out at sea.

For the past three months, all other petroleum products have been supplied by Sahara, which has a hold of the market and prices. The minister of energy has blocked most of the other traders from unloading to "avoid congestion with Sahara's ships", as he presented it at a closed-door meeting with oil distributors in the country. While most of the main petrol station networks refused to take Sahara's products in March and April, Total, Tradex and the national refining company (SONARA) resigned themselves to having to source supplies with the Nigerian trader in May. Smaller distributors, the likes of Bocom, Camoco and Green Oil, have been working with Sahara since March.

Lire aussi dans la rubrique SOCIETE

Les + récents

PCRN : Indignation face à l'interdiction de la marche contre les féminicides à Douala

SIBCA 2024 : Succès du Salon International de la Beauté et du Cosmétique Afro à Bruxelles

Rejet de la France en Afrique : Une Critique Politique Profonde et Nuancée

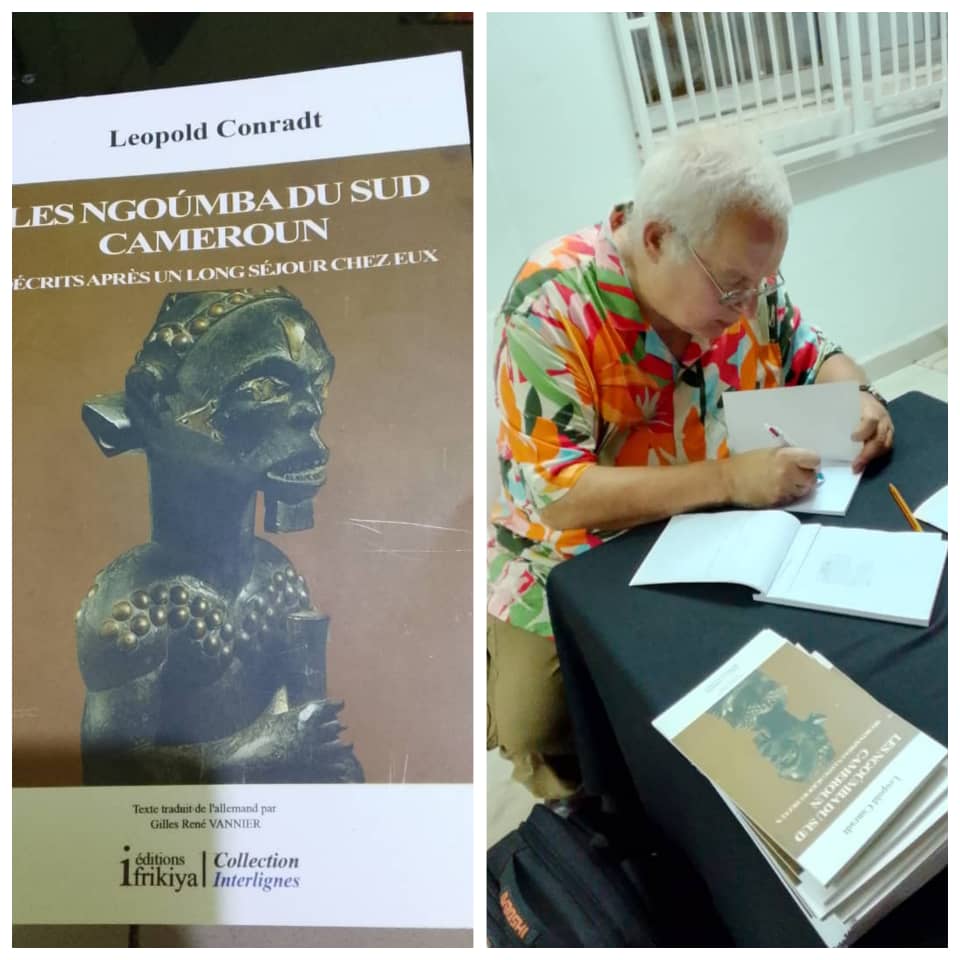

Gilles Vannier perpétue la mémoire de Léopold Conradt 150 ans après la civilisation Ngoúmba

Paul Biya : 42 ans de pouvoir, entre défilés, loyauté et enjeux sociaux au Cameroun

SOCIETE :: les + lus

26 élèves surpris en train de tourner un film osé à Bafoussam

- 30 April 2015

- /

- 993087

Brenda biya sème la terreur en boîte de nuit à Yaoundé

- 15 July 2015

- /

- 532348

Menacée de mort par sa famille car elle est lesbienne

- 03 March 2016

- /

- 415725

Oyom-Abang : une femme marche nue à Yaoundé VII

- 09 July 2015

- /

- 379140

LE DéBAT

Afrique : Quel droit à l'image pour les défunts au Cameroun ?

- 17 December 2017

- /

- 183960